The future of inventory verification has arrived — and it’s digital.

As UAE businesses embrace automation and AI-driven financial systems, traditional manual stock audits are quickly being replaced by technology-enabled verification processes. These tools not only improve accuracy and efficiency but also make audits more transparent and data-driven.

At Calculate Capitals, we’ve seen a major shift among clients toward digital stock management and reconciliation — and the results are remarkable.

Here’s a look at the top digital tools transforming inventory verification in 2025.

1. RFID Tagging and Tracking

Radio Frequency Identification (RFID) has become a game-changer for inventory control. Unlike traditional barcodes that require manual scanning, RFID uses radio waves to automatically identify and track items in real-time.

Benefits include:

- Instant inventory counts

- Reduced human error

- Real-time location tracking of goods

- Faster stock reconciliation

For large-scale operations such as warehouses and logistics companies, RFID eliminates manual bottlenecks and improves audit efficiency.

2. Cloud-Based Inventory Systems

Cloud technology allows businesses to manage inventory data from anywhere. These systems store real-time updates of purchases, sales, and stock movements in a centralized dashboard accessible to finance teams and auditors alike.

Advantages of cloud systems include:

- Secure access across multiple locations

- Automatic backups and version control

- Seamless integration with accounting platforms like Tally, Zoho, or QuickBooks

- Instant audit trail generation

This means less time spent gathering data and more time analyzing it.

3. AI-Powered Reconciliation Software

Artificial Intelligence is revolutionizing how discrepancies are detected. Modern reconciliation tools can automatically identify mismatches between stock records and accounting data — highlighting anomalies instantly.

AI-driven software provides:

- Automated data matching

- Predictive insights into stock patterns

- Detection of unusual transactions or fraud risks

For UAE SMEs, adopting AI tools can significantly reduce audit preparation time and improve accuracy.

4. Mobile-Based Verification Apps

Gone are the days of paper-based checklists. Field teams can now perform on-site audits using mobile verification apps that sync directly with central systems.

These apps allow:

- Barcode or RFID scanning via mobile devices

- Instant data upload to cloud systems

- Photo documentation for damaged or missing items

This digital workflow ensures every audit entry is verified, timestamped, and geo-tagged — adding an extra layer of reliability.

5. Blockchain for Transparent Audit Trails

While still emerging, blockchain is making waves in financial verification. It offers tamper-proof, transparent records that cannot be altered retroactively — ideal for regulatory compliance.

For businesses in the UAE dealing with high-value or multi-location inventory, blockchain ensures every movement is recorded and verified across the supply chain.

6. Integrated Dashboards for Real-Time Reporting

Modern systems consolidate audit data into interactive dashboards. Managers can view real-time stock levels, identify slow-moving items, and generate instant reconciliation reports — all from one interface.

These dashboards not only simplify audits but also empower management with actionable insights.

7. Data Analytics and Predictive Forecasting

Digital verification tools aren’t just about accuracy — they’re about foresight. Advanced analytics help predict inventory trends, detect wastage patterns, and optimize reordering cycles.

This forward-looking approach transforms audits from a compliance task into a strategic decision-making tool.

Conclusion

In 2025, digital transformation is redefining how businesses verify and control their inventory. By adopting tools like RFID, AI-based reconciliation, and cloud systems, companies can ensure higher accuracy, lower costs, and full compliance.

At Calculate Capitals, we help UAE businesses modernize their stock audits using the latest digital technologies — ensuring every count, tag, and record aligns perfectly with financial data.

Learn more in our latest blog 👇

👉 https://bit.ly/cc-blogs

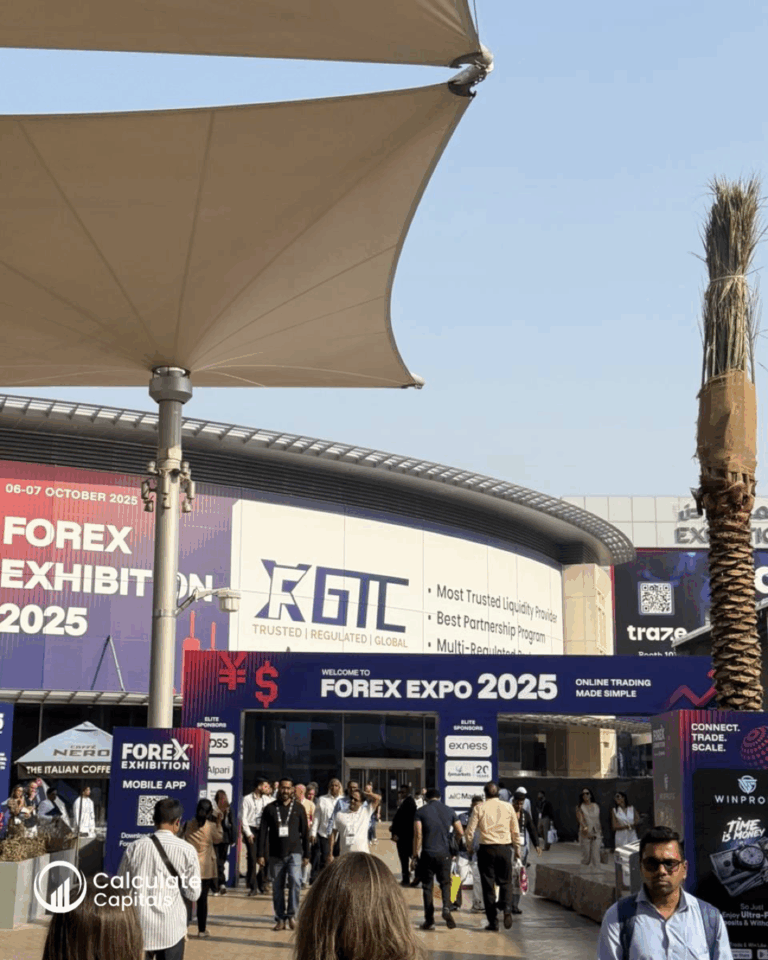

A Learning Experience with Purpose

Forex Expo 2025 is more than just a financial event. It brings together traders, fintech innovators, brokers, and asset managers from around the world. For Manas, attending the Expo was an opportunity to:

- See how global markets function in real time

- Understand how leading financial organisations approach innovation and growth

- Build connections that translate classroom knowledge into practical experience

Our goal was simple: to bridge the gap between theory and practice and help young professionals develop insights, confidence, and industry readiness.

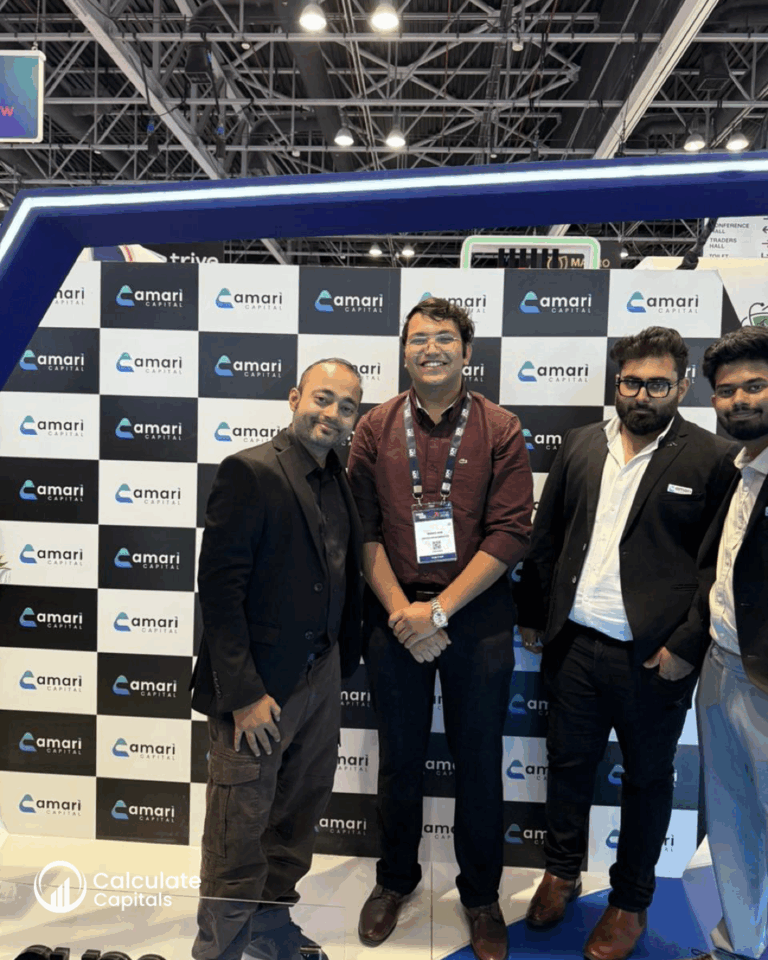

Connecting with Industry Leaders

Throughout the event, Manas engaged with professionals from diverse sectors — from trading floors to fintech startups. Each conversation offered valuable lessons about how the financial ecosystem operates and evolves.

A highlight of the experience was meeting Mr. Abhishek Kar, one of the most respected voices in the financial community. Their discussion explored the evolving landscape of financial education, the growing influence of technology in finance, and the importance of ethics and transparency in market participation. These insights offered a practical perspective that no classroom or textbook can fully capture.

Insights That Go Beyond Theory

The Expo provided a closer look at how financial innovation is shaping the industry. Discussions covered topics like AI-driven trading, sustainable finance, and the ways technology continues to make financial services more accessible and inclusive.

Manas returned with key takeaways on:

- Emerging market trends influencing investment and asset management

- The importance of networking in building meaningful business relationships

- How technology and fintech are redefining the future of finance

Such experiences transform theoretical knowledge into practical understanding and, ultimately, into impact.

Investing in People, Not Just Processes

At Calculate Capitals, we believe that investing in people is the most effective way to build long-term value. By supporting young professionals with real-world exposure, we aim to develop a workforce that is skilled, adaptable, and globally aware.

This approach reflects our broader philosophy of learning beyond the desk — where education goes beyond theory and is enriched by experience, dialogue, and exploration.

A Vision for the Future

Our participation in Forex Expo 2025 is one example of how we are reimagining professional growth. We are proud of Manas Jain’s initiative, curiosity, and willingness to learn — qualities that define the next generation of finance professionals.

At Calculate Capitals, we remain committed to creating opportunities that turn learning into leadership and ambition into achievement. Because the future of finance is not only about numbers. It is about people who never stop learning and evolving.

About Calculate Capitals

Calculate Capitals is a UAE-based financial services firm offering expert solutions in accounting, business setup, financial planning, and consultancy. We combine analytical expertise with strategic insight to help businesses make informed decisions and achieve sustainable growth.

Based in Dubai, we proudly serve clients across the UAE and beyond.